How we’ll bring your story to life.

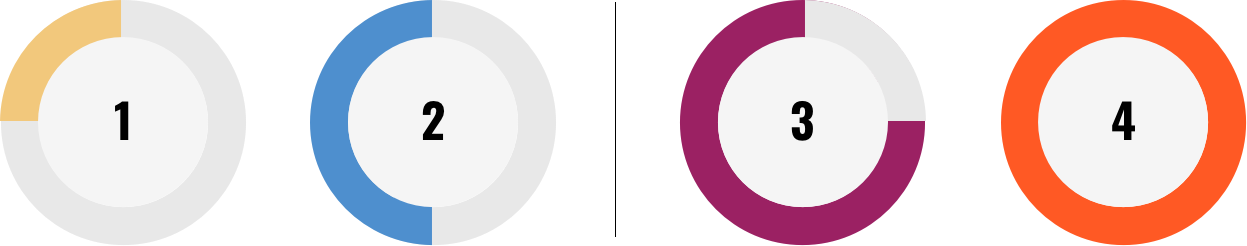

We align to SAP Activate across four phases. Depending on your

needs, we can engage for a single phase or deliver end‑to‑end. Work is iterative and collaborative to

rapidly reduce risk and validate outcomes.

1. PREPARE:

Mobilize stakeholders, confirm scope, assess current SAP

footprint, data quality, and legal mandates (SAF‑T, VAT, eInvoicing). Define success criteria and a

risk‑managed delivery plan.

2. EXPLORE:

Fit‑to‑standard workshops and solution design. Identify gaps for localization,

data extraction, validation rules, and submission flows. Build a backlog and prioritize by compliance

risk and business value.

3. REALIZE:

Configure, integrate, and develop. Implement SAF‑T/VAT

data pipelines, validations, and error handling. Execute unit, integration, and user testing to prove

accuracy and auditability.

4. DEPLOY:

Cutover, production readiness, and controlled rollout. Establish monitoring,

controls, and support operations to meet ongoing mandate updates and audits.